In this lesson, students will read primary documents related to the failure of the Bankers Trust Company in 1930. It is assumed that students have already begun their study of the Great Depression at a national level. The story of Bankers Trust in Philadelphia can be introduced as a case study for how a bank failure impacted individuals in one American city. Students will analyze the documents and evaluate the impact that the bank failure had on different individuals.

The Human Impact of Bank Failures: The Demise of Bankers Trust Company

The Human Impact of Bank Failures: The Demise of Bankers Trust Company

Essential Questions

Objectives

- Students will create a thesis statement for how bank failures during the Great Depression affected individuals involved.

- Students will read and interpret primary documents related to a Philadelphia bank that failed in 1930 for multiple perspectives on the same event

- Students will analyze, synthesize, and integrate the inferences they draw from the primary sources to support their theses.

- Students will complete a written theory on how the failure of Bankers Trust and other banks affected Philadelphians in particular and Americans in general.

- Students will reflect upon how the reactions of people to the Depression are similar to or different from their own experiences of the Great Recession today.

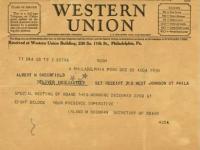

Primary Sources

Suggested Instructional Procedures

1. Ask students to create a thesis about how people in the early 1930s were impacted by the failure of local banks. They should consider the ways in which three groups of people may be affected similarly or differently: stockholders, employees, and depositors.

- Assess the creation of the thesis. Does it state position clearly?

2. Distribute the five primary source documents to the students. Have the students read and analyze the documents using the following questions:

- What is each document?

- When was each document written?

- What are its main points?

- Who wrote it? Why?

- Who read the document, and how would it have made them feel?

- What impact do you think reading the document had on the lives of the reader(s)? In the case of the newspaper articles, what impact do you think the event being described had on the people involved in the event?

3. Have students write a paper that supports or refutes their original theses pulling support from the documents. In particular, they should consider whether the impacts were similar or different for the three different groups of people. Evidential support should be cited appropriately.

Assess writing by determining if the student:

- Develops the argument thoroughly by selecting the most significant and relevant facts, concrete details, quotations, or other information and examples appropriate to the thesis and to the audience’s knowledge of the topic.

- Analyzes each primary source author’s purpose, reasons, and evidence.

- Sufficiently covers all areas of the topic.

- Conveys knowledge and ideas clearly and effectively, using appropriate vocabulary and clarifying the relationships between claim(s) and reasons, and between reasons and evidence.

- Provides a concluding statement or section that follows from or supports the argument.

4. In a classroom discussion, have students compare and contrast what they surmised about the reaction to the Depression to their own reactions to the current recession.

Specific instructional questions-

- How have they or their families been directly impacted by today’s recession?

- How similar are the students’ experiences to those of the historical persons?

- Do they feel empathy with the banker, the depositors, or the bank employees about whom they have learned in these documents? Why or why not?

5. Assess students’ historical comprehension and interpretation by asking them the essential questions. How well do they support their answers using evidence from this document activity?

Vocabulary

- Bankruptcy: A case filed under chapter 11 of the United States Bankruptcy code. The situation is caused when a person or corporation’s financial obligations exceed their ability to pay.

- Deposit: A transaction involving a transfer of funds to another party for safekeeping, e.g., a customer places funds in a checking or savings account; the customer is a “depositor.” The bank uses these deposits to make loans to other people and receives interest from those taking out the loan. In this way, the bank can give back the depositors their money and make a profit on the interest.

- Directors: People elected by shareholders to manage a company.

- FDIC: Federal Deposit Insurance Corporation - Federal guarantee or insuring of bank deposits up to $2,500 in 1934 (ceiling is $250,000 per bank in 2011).

- Liquidation: The selling of assets and the paying of liabilities in anticipation of going out of business.

- Reorganization: Formal bankruptcy may result in reorganization and continued operation of the firm or it may require liquidation and distribution of the proceeds.

- Run: A run on a bank is when many people withdraw money at one time, usually because they think the bank is not going to have enough money to repay them their deposits at a later time.

- Solvency: The ability to meet all obligations and debts.

- Stockholders: People who own a company by paying for a piece of the company (stock). They are able to elect the directors and they receive profits (dividends) when a company makes money.

Related Resources for Students

Plans in this Unit

Grade Level

Duration

Standards/Eligible Content

The May 2011 issue of Pennsylvania Legacies has been made possible by a generous gift from Mr. and Mrs. Ranney Moran.

About the Author

This unit was created by Eden Heller, Education Intern, Historical Society of Pennsylvania, and Beth Twiss Houting, senior director of programs and services at HSP, using research of Michael Regan, program director of the Network for Teaching Entrepreneurship at Temple University. It was modified and updated for SAS by Kimberly L. Parsons, Education Intern, Historical Society of Pennsylvania.

Attention Teachers!

Let us know how you used this plan and be featured on our site! Submit your story here.